Sales and Use Tax Economic Nexus Thresholds

Posted by Mark Stack on September 16, 2024

Posted by Mark Stack on September 16, 2024

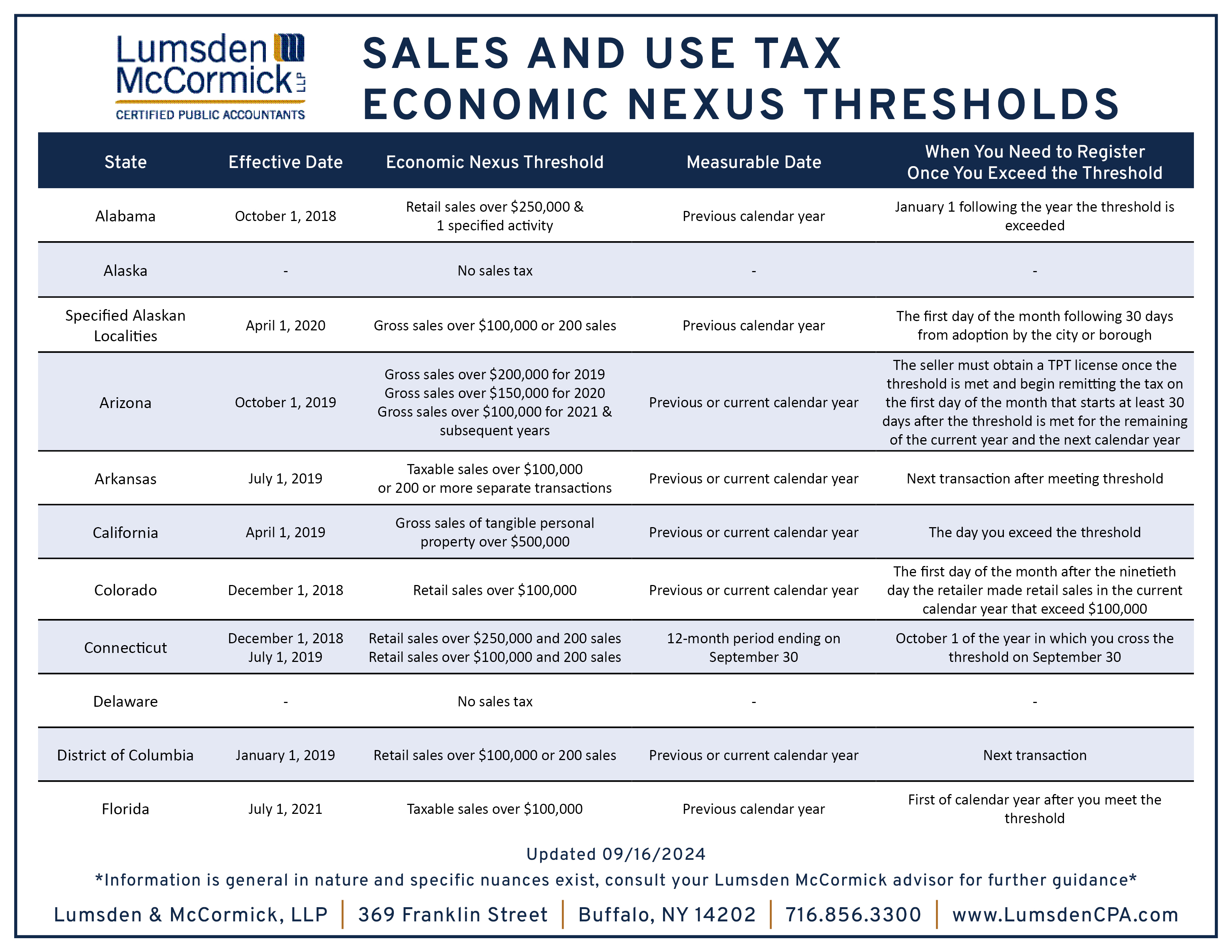

States have made many changes to their economic nexus thresholds in the wake of the landmark sales and use tax decision in South Dakota v. Wayfair from 2018. The ruling gave states broader authority to require online retailers to collect and remit sales tax on taxable sales. Businesses making sales online without a physical presence in a given state could be subject to the collection and remittance of sales and use tax. Businesses with large retail or eCommerce sales (including SaaS, cloud and digital goods, or digital services) may be particularly affected.

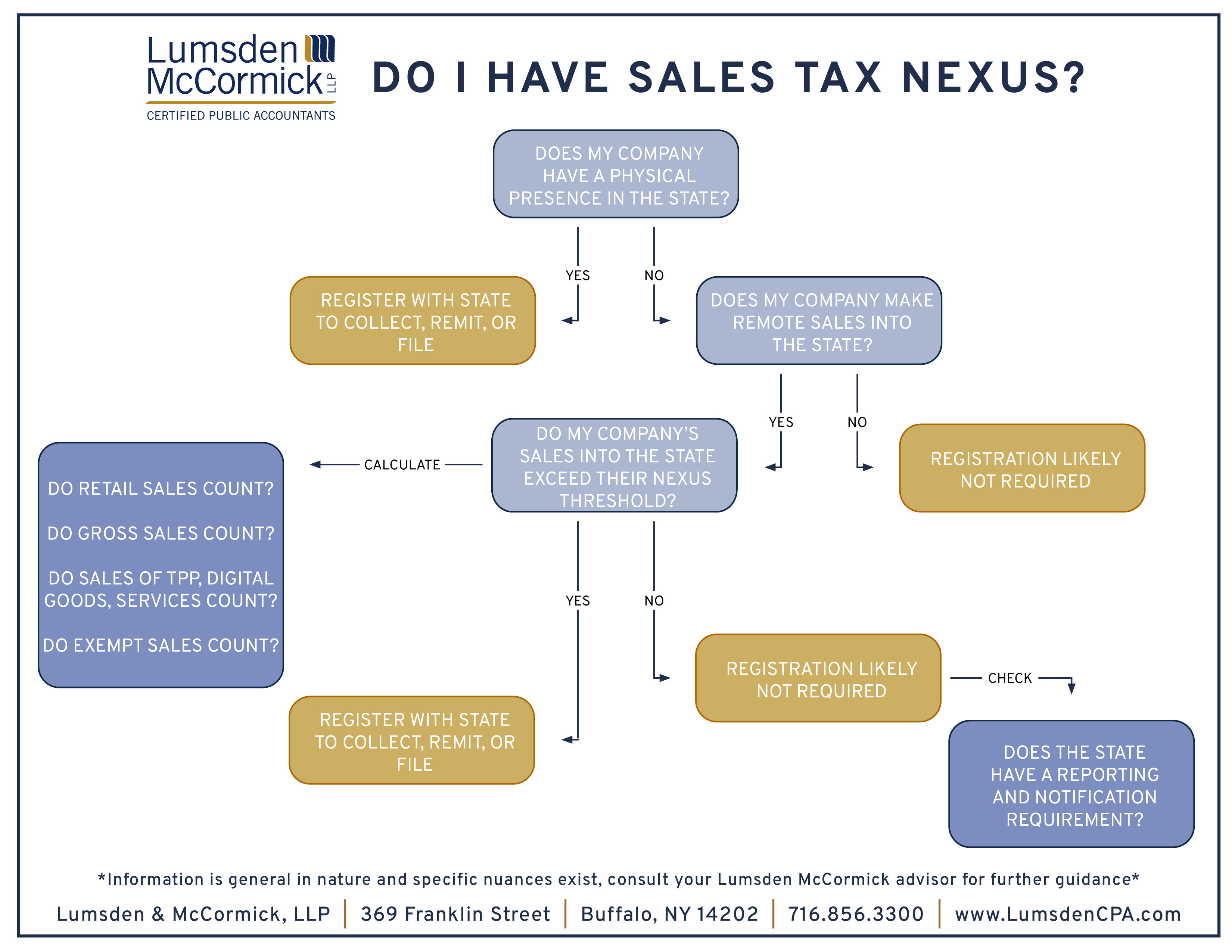

Our State and Local Tax experts are available to ensure you are currently collecting and remitting sales tax appropriately according to these changes. Use the chart below to help determine if your company has sales tax nexus.