Manufacturing/Distribution Articles

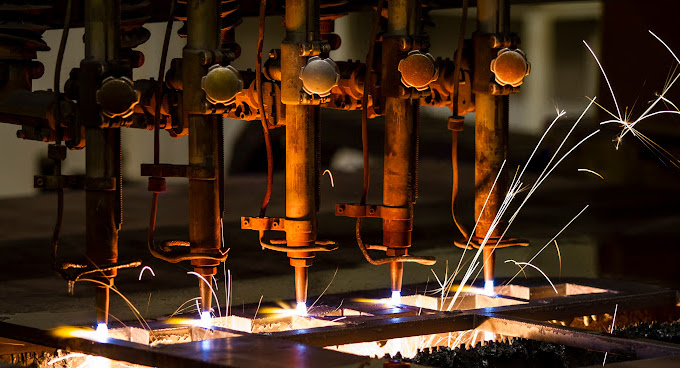

Investing in Automated Equipment: A Strategic Move for Manufacturers

Posted by Jonathan Roller on July 16, 2024

Investing in automated equipment can enhance efficiency, quality, and brand image for manufacturers, while also addressing skilled labor shortages and improving employee morale. However, it involves significant initial costs, ongoing training, maintenance, and cybersecurity considerations.

Key Midyear Tax-Reduction Strategies for Manufacturers

Posted by Kristin Re’ on July 02, 2024

As July marks the midyear point, manufacturers have a prime opportunity to reassess their tax strategies and implement measures to reduce their 2024 tax liabilities. Tailored to the unique circumstances of each business, the following seven tax-reduction strategies can help optimize financial outcomes and ensure compliance with current tax regulations.

Strategies for Sustained Profitability in Manufacturing

Posted by John George on June 18, 2024

For sustained profitability in the manufacturing sector, management must emphasize the importance of profit enhancement over revenue expansion. The strategies include optimizing overhead costs, leveraging negotiation opportunities, investing in modern equipment, strengthening the workforce, reviewing business entities, and prioritizing operational efficiency.

Unlocking Tax Savings: How a Cost Segregation Study Can Benefit Your Manufacturing Company

Posted by Kerry Roets on June 04, 2024

When manufacturers purchase, build, or improve their facilities, the associated expenses are substantial. There is an alternative approach that allows you to accelerate your tax depreciation deductions: a cost segregation study.

IRS Issues Final Regulations on Advanced Manufacturing Investment Credit

Posted by Kristin Re’ on May 07, 2024

The IRS has issued final rules for the Advanced Manufacturing Investment Credit, based on the 2022 law that encourages local semiconductor creation with big tax benefits. The final rules have some changes about choosing to use the credit as a federal tax payment.

The Advantages of Cloud Computing for Manufacturers

Posted by John George on April 09, 2024

When considering moving to cloud computing, it is essential to carefully evaluate possible service providers. Consult with reliable experts during the vendor selection process.

Segmented Statements Boost Profitability

Posted by Jonathan Roller on February 27, 2024

A segmented income statement empowers manufacturers to optimize profitability by pinpointing performance drivers.

Create an Asset Purchase Strategy with Depreciated Tax Breaks

Posted by Kristin Re’ on February 13, 2024

Manufacturers must consider factors beyond taxes when planning asset acquisitions. Other strategic or financial considerations may outweigh potential tax benefits.

Addressing Labor Shortages: Strategies for Manufacturers to Attract and Retain Skilled Workers

Posted by Jonathan Roller on January 16, 2024

Manufacturers have the option to employ both monetary and non-monetary approaches to allure and retain a proficient workforce.

2024 Tax Breaks for Manufacturers

Posted by Kristin Re’ on January 02, 2024

Every year tax provisions expire and others kick-in, so now is the time to take advantage of tax provisions that bring tax savings for 2024 including the Inflation Reduction Act.