Commercial Businesses Articles

Key Midyear Tax-Reduction Strategies for Manufacturers

Posted by Kristin Re’ on July 02, 2024

As July marks the midyear point, manufacturers have a prime opportunity to reassess their tax strategies and implement measures to reduce their 2024 tax liabilities. Tailored to the unique circumstances of each business, the following seven tax-reduction strategies can help optimize financial outcomes and ensure compliance with current tax regulations.

Borrowing from Your Closely Held Business: Structure the Deal with Precision

Posted by Douglas Muth on July 01, 2024

Borrowing from a closely held corporation at lower rates than commercial lenders can be financially beneficial, but it is essential to establish a legitimate loan agreement with proper structuring and documentation to mitigate risks such as reclassification by the IRS as additional compensation or taxable dividends.

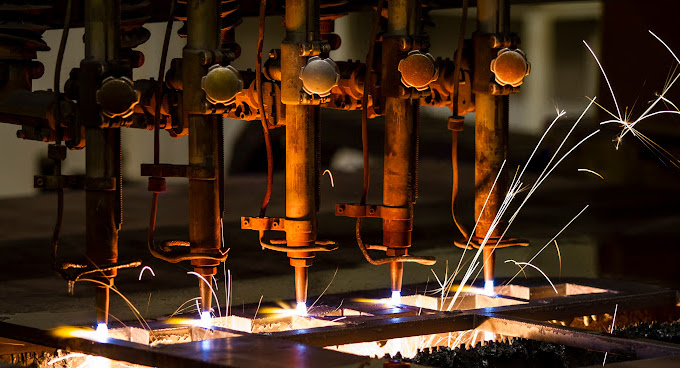

Strategies for Sustained Profitability in Manufacturing

Posted by John George on June 18, 2024

For sustained profitability in the manufacturing sector, management must emphasize the importance of profit enhancement over revenue expansion. The strategies include optimizing overhead costs, leveraging negotiation opportunities, investing in modern equipment, strengthening the workforce, reviewing business entities, and prioritizing operational efficiency.

Unlocking Tax Savings: How a Cost Segregation Study Can Benefit Your Manufacturing Company

Posted by Kerry Roets on June 04, 2024

When manufacturers purchase, build, or improve their facilities, the associated expenses are substantial. There is an alternative approach that allows you to accelerate your tax depreciation deductions: a cost segregation study.

Inflation Adjustments Enhance Health Savings Accounts for 2025

Posted by John Anderson on June 03, 2024

The IRS has announced the inflation-adjusted limits for Health Savings Accounts (HSAs) for 2025. The annual contribution limits will increase to $4,300 for individuals with self-only coverage and $8,550 for those with family coverage. These adjustments help business owners plan and offer valuable tax-advantaged benefits to employees.

IRS Issues Final Regulations on Advanced Manufacturing Investment Credit

Posted by Kristin Re’ on May 07, 2024

The IRS has issued final rules for the Advanced Manufacturing Investment Credit, based on the 2022 law that encourages local semiconductor creation with big tax benefits. The final rules have some changes about choosing to use the credit as a federal tax payment.

The Advantages of Cloud Computing for Manufacturers

Posted by John George on April 09, 2024

When considering moving to cloud computing, it is essential to carefully evaluate possible service providers. Consult with reliable experts during the vendor selection process.

Segmented Statements Boost Profitability

Posted by Jonathan Roller on February 27, 2024

A segmented income statement empowers manufacturers to optimize profitability by pinpointing performance drivers.

Create an Asset Purchase Strategy with Depreciated Tax Breaks

Posted by Kristin Re’ on February 13, 2024

Manufacturers must consider factors beyond taxes when planning asset acquisitions. Other strategic or financial considerations may outweigh potential tax benefits.

2023 Year-End Tax Planning Guide for Businesses - Real Estate

Posted by Brian Kern on February 07, 2024

As part of year-end planning and looking ahead to the coming year, real estate businesses should review how current tax rules apply to their transactions and the effects of any changes to those rules.