Articles From Lumsden McCormick

Webinar Recap: One Big, Beautiful Bill

Posted by Amanda Ornowski on August 26, 2025

This presentation by Lumsden McCormick, One Big, Beautiful Bill Webinar, covered key tax changes for businesses, individuals, and international taxpayers under the OBBB.

10 Strategies to Protect Your Manufacturing Company from Ransomware

Posted by Jonathan Roller on August 26, 2025

Ransomware attacks pose a significant threat to manufacturers, disrupting operations and jeopardizing supply chains. Implementing proactive measures such as robust backups, network segmentation, employee training, and incident response planning can dramatically reduce risk. Strengthening cybersecurity across IT and OT environments helps safeguard business continuity and protect critical assets.

You’ve Been Asked to Be an Executor - Are You Ready?

Posted by Amanda Wojtkowski on August 21, 2025

Being named an executor of an estate is a significant honor, but it comes with complex legal and financial responsibilities. From securing death certificates and managing probate to settling debts, filing taxes, and distributing assets, the role demands careful organization and clear communication with beneficiaries. Executors must act as fiduciaries, often over the course of a year or more, ensuring every step is handled prudently and transparently.

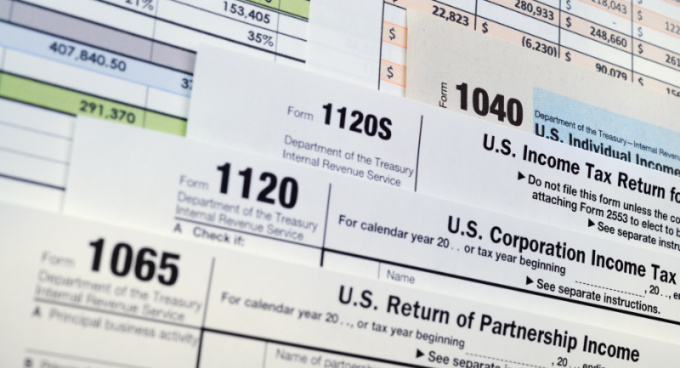

How Switching to an S Corporation Can Lower Your Self-Employment Tax Bill

Posted by Kathryn Mellon on August 20, 2025

Converting your unincorporated small business to an S corporation can significantly reduce your self-employment tax liability by allowing you to take part of your income as distributions rather than salary. While this strategy offers tax advantages, it also comes with administrative requirements and considerations around reasonable compensation and retirement contributions.

OBBB Effective Dates for Businesses

Posted by Cory Van Deusen V on August 14, 2025

The OBBB outlines key tax changes for businesses, including enhanced deductions and reporting thresholds starting in 2025. Highlights include 100% bonus depreciation, full expensing of domestic R&E, and increased 1099 thresholds, with some provisions expiring at year-end and others continuing into 2026 and beyond. Additional updates affect small business R&E elections, ERC claims, and the Qualified Opportunity Zone program.

The Hidden Risks of POD and TOD Accounts in Estate Planning

Posted by D’Marie Kleeman on August 14, 2025

POD and TOD accounts offer a fast and simple way to transfer assets directly to beneficiaries, bypassing probate. However, they can unintentionally override your will, create unequal distributions, and lack flexibility for more complex estate planning needs.

OBBB Effective Dates for Individuals

Posted by Amanda Ornowski on August 14, 2025

The OBBB introduces various extensions and amendments to the Tax Cuts and Jobs Act (TCJA). Key provisions covering tax rates, expanded deductions and changes to credits will begin rolling out in 2025.

Navigating AI for Grant Proposals

Posted by Jill Johnson on August 13, 2025

In an increasingly competitive funding landscape, nonprofits are turning to AI tools to help craft grant proposals, but success still hinges on understanding the fundamentals of proposal writing. While AI can streamline the process, funders value authenticity, customization, and adherence to guidelines, making human oversight and strategic storytelling essential.

Maximizing Value with the Historic Rehabilitation Tax Credit

Posted by Kerry Roets on August 13, 2025

The Historic Rehabilitation Tax Credit (HTC) offers financial incentives for preserving historic buildings. It provides insights into the application process and potential challenges, helping to enhance the value of historic properties.

Choosing the Right Business Entity

Posted by Alexander Intihar on August 11, 2025

Choosing the right business entity is essential for tax efficiency and operational success. This guide compares five common structures, sole proprietorship, S corporation, partnership, LLC, and C corporation; highlighting how each is taxed and what compliance requirements they entail. Understanding these differences helps entrepreneurs align their entity choice with financial goals and growth plans.