Articles From Lumsden McCormick

Optimizing Nonprofit Workforce Efficiency Through Job Rotation

Posted by Amina Diallo on June 19, 2024

Job rotation is a strategic initiative that allows nonprofit employees to enhance their skills, productivity, and adaptability by switching roles within the organization. This practice benefits both the organization and the employees, as it ensures continuity of operations, strengthens internal controls, increases employee value and commitment, and fosters a supportive work environment.

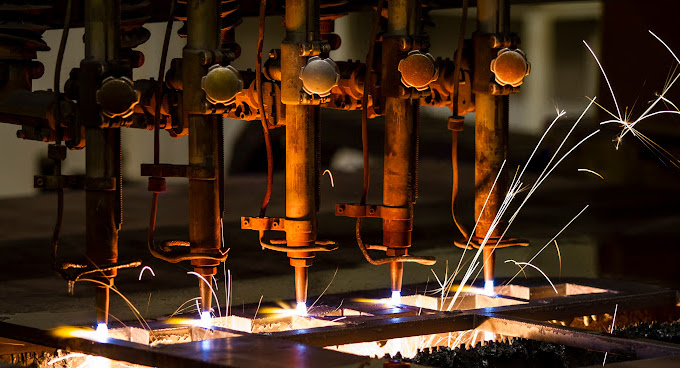

Strategies for Sustained Profitability in Manufacturing

Posted by John George on June 18, 2024

For sustained profitability in the manufacturing sector, management must emphasize the importance of profit enhancement over revenue expansion. The strategies include optimizing overhead costs, leveraging negotiation opportunities, investing in modern equipment, strengthening the workforce, reviewing business entities, and prioritizing operational efficiency.

Safeguard Your Digital Legacy: A Must-Do for Every Estate Plan

Posted by Cheryl A. Jankowski on June 12, 2024

Digital assets often leave no paper trail, making it crucial to include them in your estate plan to ensure your family can locate and access them. Take inventory of your digital assets, provide access instructions, and ensure your representatives have the necessary legal consent to manage these accounts; contact us for further assistance.

Understanding Corporate Estimated Tax Payments

Posted by Amanda Ornowski on June 10, 2024

To avoid penalties on your next quarterly estimated tax payment, your business should aim to pay the minimum required estimated tax using one of four methods: the current year method, the preceding year method, the annualized income method, or the seasonal income method.

Incorporate Foreign Assets into Your Estate Plan

Posted by Amanda Mooney on June 06, 2024

Neglecting international holdings in estate plans may lead to dual taxation, as U.S. citizens face federal taxes on global assets which could also be taxed abroad. Although a foreign death tax credit might mitigate this, it’s not guaranteed, and professional advice should be sought.

Preparing for Your Next Form 990 Filing

Posted by Jill Johnson on June 05, 2024

Nonprofits should maintain accurate records and work to prevent fraud throughout the year to ensure timely and precise filing of Form 990, including Schedule G and foreign operations details, by the next IRS deadline.

Unlocking Tax Savings: How a Cost Segregation Study Can Benefit Your Manufacturing Company

Posted by Kerry Roets on June 04, 2024

When manufacturers purchase, build, or improve their facilities, the associated expenses are substantial. There is an alternative approach that allows you to accelerate your tax depreciation deductions: a cost segregation study.

Inflation Adjustments Enhance Health Savings Accounts for 2025

Posted by John Anderson on June 03, 2024

The IRS has announced the inflation-adjusted limits for Health Savings Accounts (HSAs) for 2025. The annual contribution limits will increase to $4,300 for individuals with self-only coverage and $8,550 for those with family coverage. These adjustments help business owners plan and offer valuable tax-advantaged benefits to employees.

Enhance Your Wealth with a Health Savings Account (HSA)

Posted by Robert Ingrasci on May 30, 2024

A Health Savings Account (HSA) offers affluent individuals a strategic way to reduce healthcare costs and federal taxes while enhancing their retirement savings and estate planning. HSAs allow tax-free withdrawals for medical expenses and provide unique benefits for beneficiaries, particularly spouses, allowing for continued tax-free growth and usage.

Treasury, IRS Release Final Regulations on Transfer of Certain Energy Tax Credits

Posted by Kristin Re’ on May 28, 2024

The Department of the Treasury and the IRS on April 25 released long-awaited final regulations (T.D. 9993) related to the transfer of certain credits under Internal Revenue Code Section 6418, added by the Inflation Reduction Act (IRA), which describes rules for the election to transfer eligible credits in a taxable year.